13 Dec What your need to know from the to find good foreclosed family

- What your need to know about buying a foreclosed home

- Just how do home foreclosures works?

- Particular property foreclosure

- Financing a good foreclosed domestic

- Cons of buying a foreclosed home

- A long time process with increased documents

- Household position inquiries

- Race

- Pros of buying a foreclosed home

- Deal costs

- Financing opportunities

- Generate smart real estate financial investments together with Belong

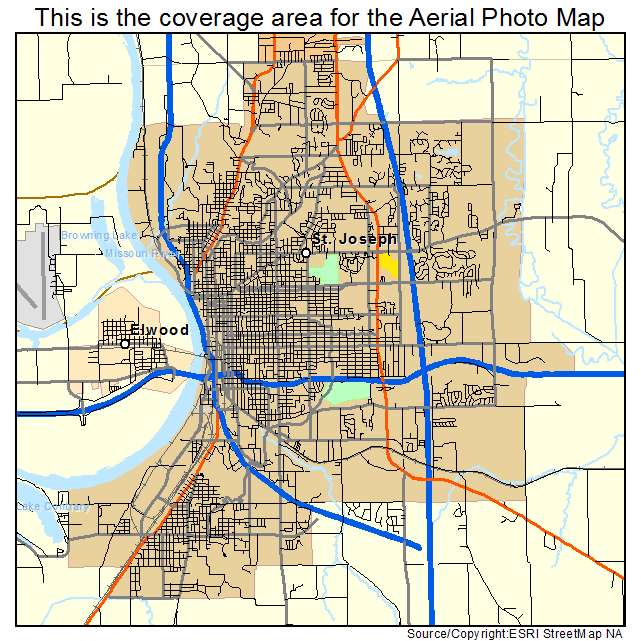

Discover foreclosed residential property during the nearly every housing market in the united states, and purchasing a beneficial foreclosed house is simpler following mid-2000s financial drama. Pursuing the moratorium on the property foreclosure, in response toward COVID-19 pandemic, finished from inside the , people asked an increase in foreclosure. But not, our company is nevertheless seeing a restricted also have and high race. The very best incentive when you look at the to get good foreclosed house is will cost you, but volatile timelines, repairs, and you may strong race get dissuade you against purchasing an effective foreclosed household.

You will find some type of foreclosure: pre-foreclosure, small revenue, sheriff’s income, bank-owned, and you can bodies-had. The types of foreclosure possess novel services, plus the get techniques varies. Consider going for a realtor who’s familiar with the new property foreclosure processes. They will be capable offer specific opinion according to its event.

How do house foreclosures really works?

Whenever a proprietor can no longer generate payments on their mortgage, the bank requires arms of the house. The lending company always sends a notice away from standard just after ninety days away from skipped costs. Tend to, the new resident comes with the opportunity to policy for an alternate percentage package on the bank before the house is sold. While to invest in an effective foreclosed household, youre purchasing the household from the lender, not the fresh new residence’s brand-new manager.

Variety of foreclosures

Pre-foreclosure: While the holder is within default on their mortgage, he could be notified by the bank. If the resident can sell the home inside the pre-foreclosures period, they are able to prevent the foreclosure techniques and lots of of impacts on the credit score.

Brief sales: In the event the a resident try long lasting financial hardship, they’re able to to offer their property inside the a preliminary profit. The lending company must invest in deal with shorter towards the assets than the fresh resident currently owes on their financial. Short transformation should be extended as bank should function and you may agree the offer.

Sheriff’s purchases: Sheriff’s conversion process is actually deals held just after property owners default on the money. These deals is triggerred of the regional law enforcement, hence the name sheriff’s deals. Within these auctions, our home is available toward large bidder.

Bank-possessed functions: If a house cannot offer at auction, it will become a real estate manager (REO) possessions. The borrowed funds lender, financial, or home loan buyer possesses the house or property, and they types of features are occasionally also referred to as bank-owned residential property.

Government-had attributes: Similar to REO services, such family was bought playing with an FHA or Va loan, one another regulators-right back funds. When this type of functions is actually foreclosed and don’t promote at auction, it getting regulators-manager attributes. Up coming, they are offered by brokers who work on the part of the fresh agency and therefore granted the borrowed funds.

Funding a beneficial foreclosed household

If you’re all bucks offers gives their most significant advantage when to acquire a great foreclosed household, some financing options are readily available for investment properties. Understand that personal lenders may be less inclined to fund the purchase regarding a foreclosed household. So you can expedite the method, think opting for a loan provider and having pre-recognized to possess an interest rate.

When you find yourself shopping for to invest in a foreclosure, we recommend exploring the authorities-backed money options available to those https://paydayloanflorida.net/wewahitchka/ who meet the requirements. Good 203(k) mortgage is a kind of financial support provided with the fresh Government Housing Management (FHA). There are numerous different varieties of 203(k) financing. You are able to essentially be billed a home loan cost to help you offset the bank’s risk. You’ll also select the rates of interest for those sort of loans are about 0.25% higher than antique fund.